Paying taxes is inevitable—but finding additional taxation deductions is enviable. If you’re a salaried employee, you may well be surprised to discover that your deductions feature certain job-related costs.

The Importance of the two% Floor

To subtract workplace expenditures, your complete itemized deductions must surpass the standard deduction. You have to additionally fulfill what’s called "the twoper cent floor." This is certainly, the full total of the expenses you deduct must be higher than 2per cent of adjusted gross income, and you may deduct only the expenditures over that amount.

An individual will be sure you qualify to deduct work-related expenses as an employee, you’ll have to make sure your deductions qualify. All expenses needs to be sustained during the taxation 12 months, must certanly be trade- or business-related, and needs to be “ordinary and needed.” The expenses don’t need to be required, however: In IRS-speak, a required expenditure is simply one that is helpful and appropriate for your organization. And, naturally, the expense can’t be reimbursed by your company.

Here are some of the more widespread workplace deductions. As with every deductions, it's vital that you keep step-by-step documents and/or receipts.

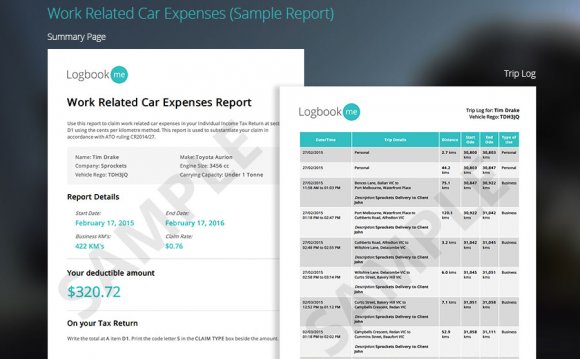

Auto and Travel Expenses

Business vacation costs are some of the most typical work-related deductions.

Deductible auto expenses feature costs for traveling between one workplace and another (not including a house workplace), checking out consumers, probably a business conference away from your regular workplace or addressing a short-term workplace. In the event that you work in two locations in one time, whether for similar manager, you can deduct the price of going among them.

When you yourself have no permanent workplace and work frequently within your metropolitan location, you are able to deduct the expense of travel outside that metropolitan location. You can't, however, subtract typical commuting costs in your metropolitan area.

For commuters, the expense of planing a trip to and from work, whether by train, car, taxi or coach, are considered private expenses—even when you do work on the journey. The cost of parking at your permanent workplace isn't deductible, but parking to attend a business meeting is. Likewise, tolls and fuel are not deductible for regular transport to the office, but they are allowable for work-related trips.

In the event that you use your automobile for company reasons you can subtract either the standard mileage rate (57.5¢ per mile in 2015) or real car expenditures for 12 months. For rented automobiles, whichever strategy you choose in the first year may be the one you'll be expected to make use of for the remaining years of the lease.

Work-related travel expenses tend to be allowable, if you incurred the costs for a taxi, plane, train or car while working away from home on an assignment that persists twelve months or less. You'll be able to subtract the expense of washing, dishes, baggage, phone costs and tips when you are on business in a short-term setting.

You have got a choice about how to deduct the expense of dishes which are business-related, or consumed while on an unreimbursed vacation excursion. You can easily subtract 50percent associated with the actual dinner price, and take 50percent associated with every diem price when it comes to location of travel. A summary of these places is available from the IRS website at www.IRS.gov.

Other Common Deductions

Below are a few various other business expenditures employees can deduct on the taxation return:

- Dues to professional communities, excluding lobbying and political businesses.

- Office at home prices. The office must be your principal place of business and get for the ease of your employer—not just useful in conducting your job.

- Job search expenditures inside existing occupation, even though you don’t land a work. This consists of from the expense of making and copying your application to travel costs you incur while interviewing or searching for a job.

- Legal charges regarding doing or maintaining your job.

- The price of a passport for a company travel.

- Union dues and costs. But you cannot subtract the part of the costs that covers ill, accident or death advantages or even for a pension investment, although the costs are required dues.

- Work clothes and uniforms that are not ideal for everyday use consequently they are a condition of your employment.

Uncertain if for example the company expenditures are deductible? TurboTax will ask you easy questions regarding your expenses and tell you those it is possible to deduct, or if you tend to be better off using the standard deduction.

See also:RELATED VIDEO